NEW AFRICAN PROPERTIES LIMITED

"the Company" or "New African Properties" or "NAP"

Incorporated in the Republic of Botswana,

UIN BW00001055962

BSE share code: NAP-EQU ISIN code: BW 000 000 1049

Nature of investment

The ownership of linked units in a variable rate loan stock company is tax efficient as profits are distributed by means of a dividend and a debenture interest payment which is larger than the dividend. The full amount of interest is deductible from income of the variable rate loan stock company as an expense incurred in the production thereof. The Income Tax (Amendment) Act of 2019 restored this position after the 2018 Amendment temporarily restricted this deductibility.

Dividends paid by the company are subject to withholding tax which is a final tax. Interest is also subject to withholding tax, unless the unitholder is exempt, and this tax can be credited against tax payable by the recipient. Any capital gains on disposal of linked units after one year of acquisition are exempt from taxation under the current taxation regime as the Company has offered more than 49% of its linked units to trade on the Botswana Stock Exchange. In addition to being able to vote on issues that affect them, unitholders' interests are protected through the application of a code of governance and the appointment of independent directors to the Board.

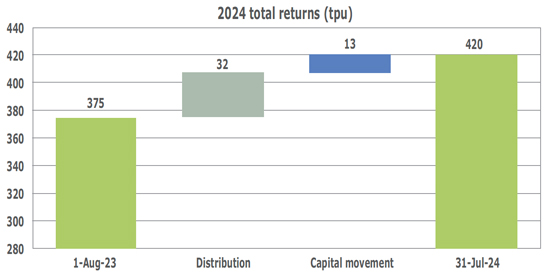

Returns to investors for 2024

Returns to investors comprise an income return, being the distributions paid for the period, together with the capital growth. This capital growth is based on movement in unit price.

The income return to investors from the 32.28 thebe distribution equates to a 8.6% return for the year on the opening unit price of 375 thebe. The total return for the year amounts to 45.28 thebe per linked unit, taking into account the 13 thebe increase in the unit price to 388 thebe by 31 July 2024, equating to a total unitholder return of 12.1% for 2024.

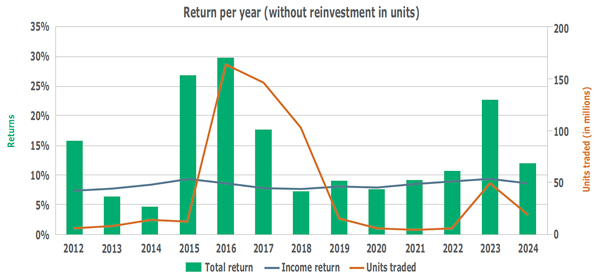

Returns to investors since listing

Income returns have remained relatively constant since listing, fluctuating in a band between 7.35% and 9.50%, whereas unit price movement has been more variable. The last two years has seen a gradual, but marked increase in the unit prices off the back of day-to-day trading. This is in contrast to the past where pointed movements in unit price were driven by larger sized trades.

The aggregate total return to investors since listing amounts to 248% (2023: 225%) on the 200 thebe listing price. Distributions contributed 154% (2023: 138%) while the increase in the unit price contributed 94% (2023: 87%). This total return equates to a compound total annual return of 10.2% (2023: 10.3%) since listing.

With a reinvestment in units the compound annual return increases to 13.5% (2023: 13.3%).